Last night, Apple lowered the interest rate of the Apple Card Savings Account to a new 3.75% APY. While this is down from its highest point at 4.5% APY, Apple’s rate still holds quite strong to the rest of the banking industry.

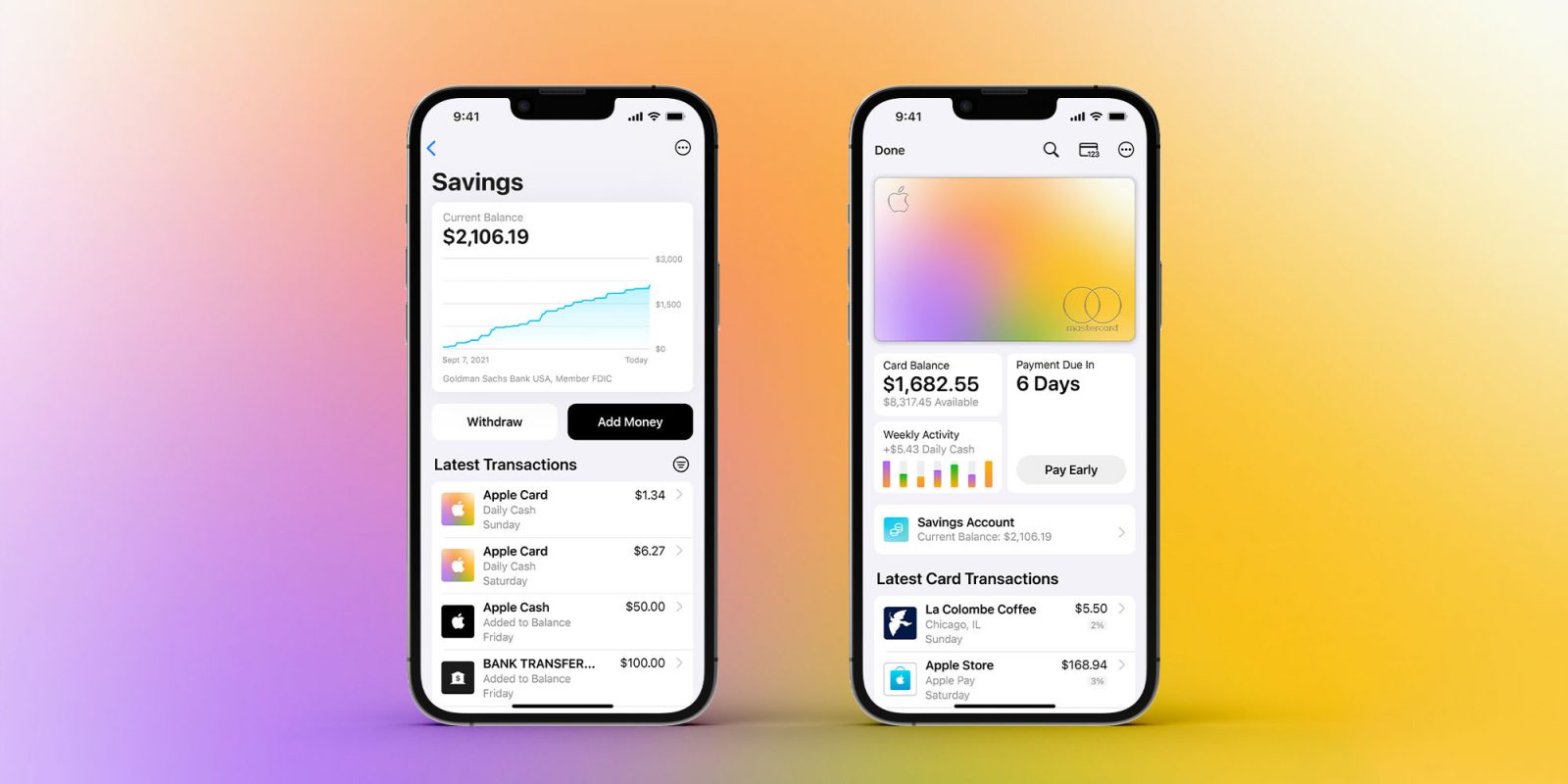

Apple begun offering the Apple Card Savings Account in April 2023, in partnership with Goldman Sachs. It offered an industry-leading 4.15% APY at the time, and has received a number of adjustments since.

Here’s how Apple’s savings account rate compares to the rest of the industry, as of March 26th, 2025:

| Bank | Interest Rate |

|---|---|

| Ally | 3.70% APY |

| American Express | 3.70% APY |

| Capital One | 3.70% APY |

| Discover | 3.70% APY |

| Marcus by Goldman Sachs | 3.75% APY |

| Apple Card Savings | 3.75% APY |

| SoFi Savings | 3.80% APY |

| Wealthfront | 4.00% APY |

| Robinhood | 4.00% APY |

| Barclays Tiered Savings | 4.15%-4.40% APY |

Of course, any of these rates will be far higher than what big banks tend to offer. Banks such as Chase, Bank of America, and Wells Fargo all offer interest rates below 0.03% APY.

Apple’s savings account is exclusively available for Apple Card holders. You can learn more about Apple Card and its varying perks here.

Are you an Apple Card user? What do you think about Apple’s savings account offering? Let us know in the comments.

My favorite Apple accessories on Amazon:

- Anker 25K Compact Power Bank with retractable cable

- MOFT Magnetic Wallet Stand, fits up to 3 cards

- AirTag 4-pack (on sale for 30% off!)

- Anker MagSafe 2-in-1 Wireless Charging Stand with Qi2

- AirPods Pro 2 (USB-C)

- SanDisk Extreme 2TB USB-C SSD, up to 1050MB/s

Follow Michael: X/Twitter, Bluesky, Instagram

FTC: We use income earning auto affiliate links. More.

Comments