Apple Card

A new kind of credit card. Created by Apple, not a bank. It launched in the US on August 20th, 2019.

Apple Card is the credit card designed by Apple and backed by Goldman Sachs. It offers a variety of perks and rewards, including 0% financing on Apple products. Here’s everything you need to know.

Table of contents

Application

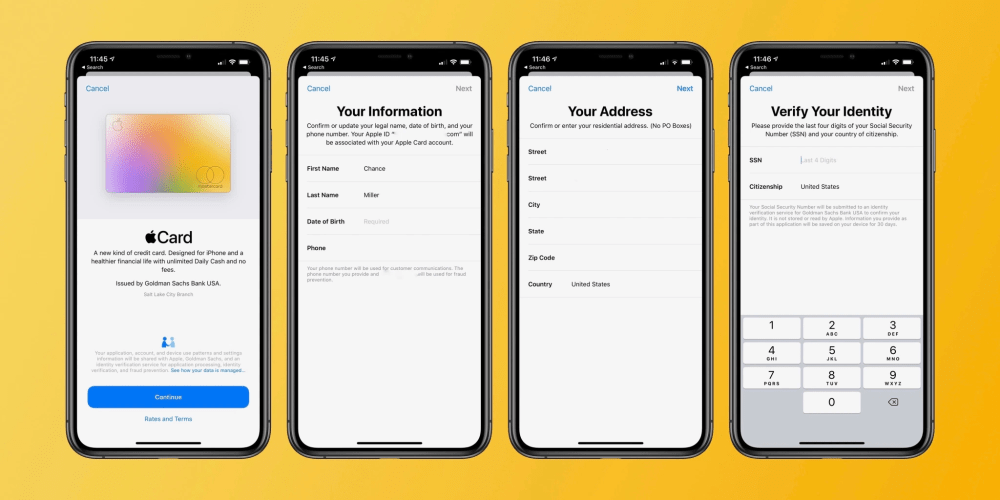

The application process for Apple Card is incredibly straightforward. Once you’re invited to apply, you can do so directly in the Wallet app on iPhone. Much of your information will be pre-filled based on your Apple ID.

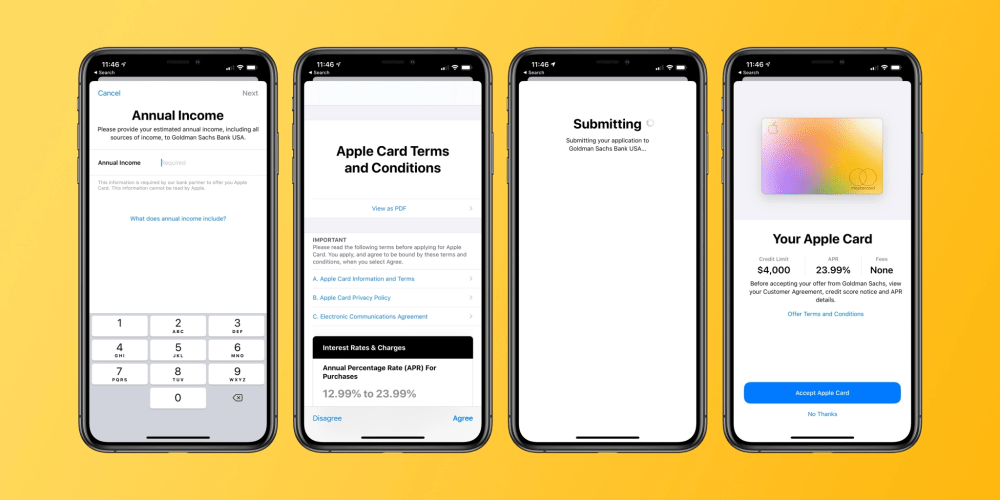

Details like your address, phone number, and name are pre-filled based on my Apple ID information. You do have to enter my annual income, though. Once you enter all of your details, you’ll be presented with the Terms and Conditions. Once you agree, your application is submitted to Goldman Sachs for approval.

After your approval, you can request to have your physical titanium Apple Card delivered, with Apple saying it should come within 6-8 business days.

Apple Card Approval Odds

Variable APRs range from 10.99% to 21.99% based on creditworthiness. Apple highlights several factors that can affect approval:

- If you’re behind on debt obligations or have previously been behind

- If you have negative public records

- If you’re heavily in debt or your income is insufficient to make debt payments

- If you frequently apply for credit cards or loans

- If your credit score is low

Apple Card is backed by Goldman Sachs, and Goldman Sachs uses TransUnion and other credit bureaus to evaluate your application. Apple says that if your FICO9 score is lower than 600, Goldman Sachs might not be able to approve you.

The Apple Wallet app

Everything you’ll need to do with Apple Card is managed through the Wallet app on iPhone. This has several benefits because it means everything is done at a system level. Details are closely aligned with your Apple ID, and there’s no need to log-in to a separate app every time you need to check your Apple Card.

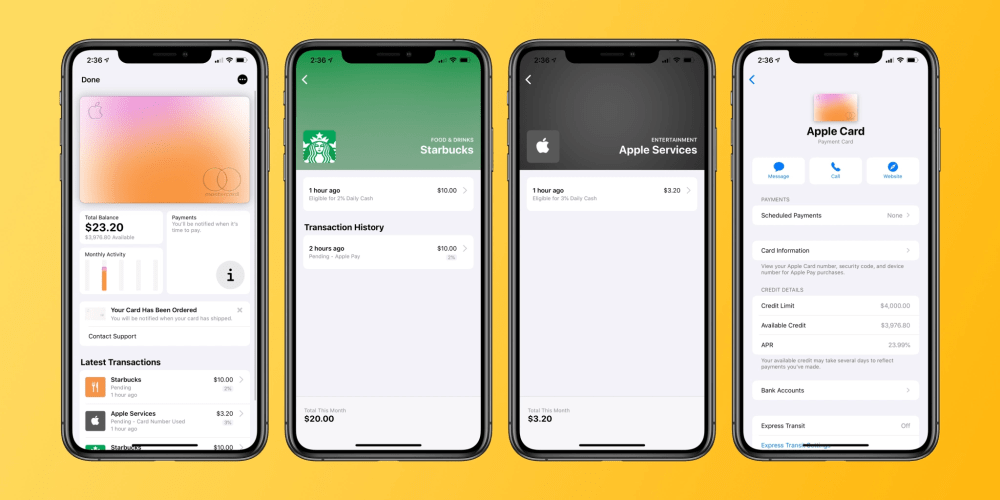

The virtual card design of Apple Card is a neat, responsive heat map based on the different categories in which you’ve spent money. For instance, if you use Apple Card for Starbucks and App Store purchases, the card will be a mix of pink and orange.

For payments, it will let you pay your full balance, your statement balance, or any other amount. It will also show you detailed information about the interest fees associated with each payment option. You can also schedule autopay to coincide with paydays.

Tapping the three dots in the upper-right corner of the Apple Card interface in Wallet lets you quickly contact support through Apple Business Chat, on the web, or via phone. You can also manage your scheduled payments here. If you already have a bank account linked to Apple Pay Cash, you can use that same one for your credit card without having to reenter the information.

Also here you can view your credit details, as well as card information like your card number, expiration, and security code. You can also request a new card number if you think yours might have been compromised.

One of the most popular things about its integration with the Wallet app is how straightforward the transactions list is. Many card companies display a jumbled list of transactions and merchant IDs, but the Wallet app clearly shows you the merchant name and a map of where the transaction was made.

Apple Card Rewards

While you might find better cashback options than Apple Card, Apple’s implementation is by far the easiest to use. You earn 3% on Apple purchases, 2% on Apple Pay purchases, and 1% on any purchases made with the physical card. In the transactions list in the Wallet app, you’ll clearly see what each purchase earned you in cashback.

Apple Card 3% partners:

- Apple

- Uber and Uber Eats

- Wallgreens

- T-Mobile

- Nike

- Exxon and Mobil

- Panera Bread

This means that anything billed through Apple, including Apple TV Channels, App Store and iTunes purchases, AppleCare, Apple Music, and in-app subscriptions, is eligible for 3 percent back. This also includes services like Apple TV+ and Apple Arcade. The moral of the story here is that you likely won’t find much better than 3% for those recurring subscriptions.

Because it runs on the MasterCard network, you also get access to those benefits as well, including things like MasterCard travel deals, special events, and more. Once the card is more widely available, you’ll be able to view all of those benefits here.

Cashback is delivered daily through what Apple calls “Daily Cash.” At the end of every day, you’ll receive an Apple Pay Cash credit for your rewards for the day. You can either spend this money using Apple Pay Cash or transfer it to your bank This is far better and more intuitive than other card companies, which often credit cashback once a billing cycle.

0% Financing

Apple Card also offers 0% on Apple product purchases. This includes nearly every Apple product, such as iPhone, iPad, Mac, AirPods, Apple Watch, and most accessories.

The financing options vary by product. For example, higher-priced items like the Mac and iPad Pro offer 12-month financing with 0% interest. Cheaper items like AirPods and AirPods Pro offer 6-month financing with 0% interest. Apple Watch is excluded from these financing options for unknown reasons.

For example, you can finance AirPods Pro with 0% interest for 6 months, which equates to $41.50 per month. AirPods with Wireless Charging Case can be financed for $33.16 per month. You can finance a 16-inch MacBook Pro starting at $199.91 for 12 months.

How to buy with Apple Card Monthly Installments:

- Select Apple Card Monthly Installments when you check out

- Since you already have Apple Card, you’ll skip the application process

- Complete your purchase

Physical Apple Card

After your approval, you can request to have your physical titanium Apple Card delivered, with Apple saying it should come within 6-8 business days.

The physical card does not display your card number, so you’ll have to go to the Wallet app to view that information. For online purchases where Apple Pay is not accepted, your card number is automatically added to Safari to easily complete the transaction.

Fees

Apple Card has no fees, including foreign transaction fees, annual fees, balance transfer fees, and more. For many people, this should be a factor when rewards shopping, as many cards with more lucrative rewards might have a steep annual fee.

Apple Car uses a “semi-permanent” card number. This means you use the same number until you have an issue. When you do, you can easily request a new number via the Wallet app. There’s no support for per-transaction card numbers at this point.

Apple Card Family

In April, Apple officially announced its new Apple Card Family feature. This feature lets users share the same Apple Card with other family members. Apple says that it created this feature to “reinvent how spouses, partners, and the people you trust most share credit cards and build credit together.”

Apple Card customers can add up to five people to their Apple Card account by sharing Apple Card with them in the Wallet. All users must be part of the same Family Sharing group in order to be invited to Apple Card Family, and be 13 years of age or older.

Apple says that Apple Card can be shared with any eligible user who is 18 years or older as a co-owner so that both users build credit together. This gives you the flexibility of a combined limit and transparency into each other’s spending. You also share the responsibility of making payments and deliver the convenience of a single monthly bill to pay.

Apple Card Family is available now with iOS 14.6, which was released in May. Coming later this summer, Apple Card users will be able to merge two accounts.